6 Easy Facts About Top 30 Forex Brokers Shown

Wiki Article

Not known Facts About Top 30 Forex Brokers

Table of ContentsSome Known Details About Top 30 Forex Brokers Getting The Top 30 Forex Brokers To WorkThe Ultimate Guide To Top 30 Forex BrokersThings about Top 30 Forex BrokersExcitement About Top 30 Forex BrokersSome Known Facts About Top 30 Forex Brokers.Not known Incorrect Statements About Top 30 Forex Brokers About Top 30 Forex Brokers

Each bar chart represents one day of trading and contains the opening price, highest price, cheapest rate, and closing price (OHLC) for a profession. A dash on the left stands for the day's opening rate, and a comparable one on the right represents the closing cost.Bar graphes for currency trading assistance investors identify whether it is a customer's or vendor's market. The upper portion of a candle is used for the opening cost and highest rate factor of a currency, while the lower portion suggests the closing cost and lowest price point.

The 9-Minute Rule for Top 30 Forex Brokers

The formations and shapes in candlestick graphes are utilized to identify market instructions and movement. Several of the a lot more typical developments for candlestick charts are hanging man - https://anotepad.com/note/read/a5h2fbab and shooting star. Pros Largest in terms of daily trading volume in the globe Traded 24-hour a day, 5 and a half days a week Starting capital can quickly increase Usually complies with the very same guidelines as regular trading Extra decentralized than typical stock or bond markets Cheats Take advantage of can make forex trades really unpredictable Utilize in the range of 50:1 is usual Needs an understanding of economic fundamentals and indicators Less guideline than various other markets No revenue producing instruments Foreign exchange markets are the largest in terms of everyday trading volume around the world and for that reason use one of the most liquidity.Banks, brokers, and dealers in the forex markets allow a high quantity of take advantage of, implying investors can regulate large positions with relatively little money. Take advantage of in the variety of 50:1 prevails in foreign exchange, though even higher quantities of take advantage of are readily available from certain brokers. However, utilize must be made use of meticulously due to the fact that several unskilled investors have actually suffered substantial losses utilizing even more take advantage of than was essential or sensible.

The Main Principles Of Top 30 Forex Brokers

A money investor needs to have a big-picture understanding of the economic situations of the numerous nations and their interconnectedness to comprehend the principles that drive currency worths. The decentralized nature of forex markets indicates it is less controlled than various other economic markets. The level and nature of guideline my company in foreign exchange markets rely on the trading jurisdiction.The volatility of a certain money is a function of multiple elements, such as the national politics and business economics of its country. Occasions like economic instability in the type of a settlement default or inequality in trading relationships with one more money can result in considerable volatility.

The Greatest Guide To Top 30 Forex Brokers

Money with high liquidity have an all set market and show smooth and predictable cost activity in action to external occasions. The United state dollar is the most traded currency in the globe.

The 5-Minute Rule for Top 30 Forex Brokers

In today's information superhighway the Foreign exchange market is no much longer solely for the institutional investor. The last 10 years have seen an increase in non-institutional investors accessing the Forex market and the benefits it provides. Trading platforms such as Meta, Prices Estimate Meta, Trader have been established particularly for the private capitalist and academic material has actually ended up being much more easily offered.

The Of Top 30 Forex Brokers

International exchange trading (foreign exchange trading) is a worldwide market for getting and selling currencies - Tickmill. 6 trillion, it is 25 times larger than all the globe's stock markets. As an outcome, prices change regularly for the currencies that Americans are most likely to make use of.

All money trades are carried out in sets. When you sell your currency, you receive the repayment in a different money. Every traveler that has obtained foreign currency has done forex trading. For example, when you go on trip to Europe, you exchange dollars for euros at the going rate. You market U.S.

Unknown Facts About Top 30 Forex Brokers

Spot transactions resemble trading currency for a journey abroad. Places are contracts in between the trader and the market maker, or dealer. The trader gets a certain currency at the buy price from the market manufacturer and offers a different money at the asking price. The buy cost is somewhat more than the market price.This is the deal expense to the trader, which subsequently is the earnings made by the market maker. You paid this spread without recognizing it when you exchanged your bucks for international money. You would observe it if you made the deal, canceled your trip, and after that attempted to exchange the money back to dollars right away.

Not known Facts About Top 30 Forex Brokers

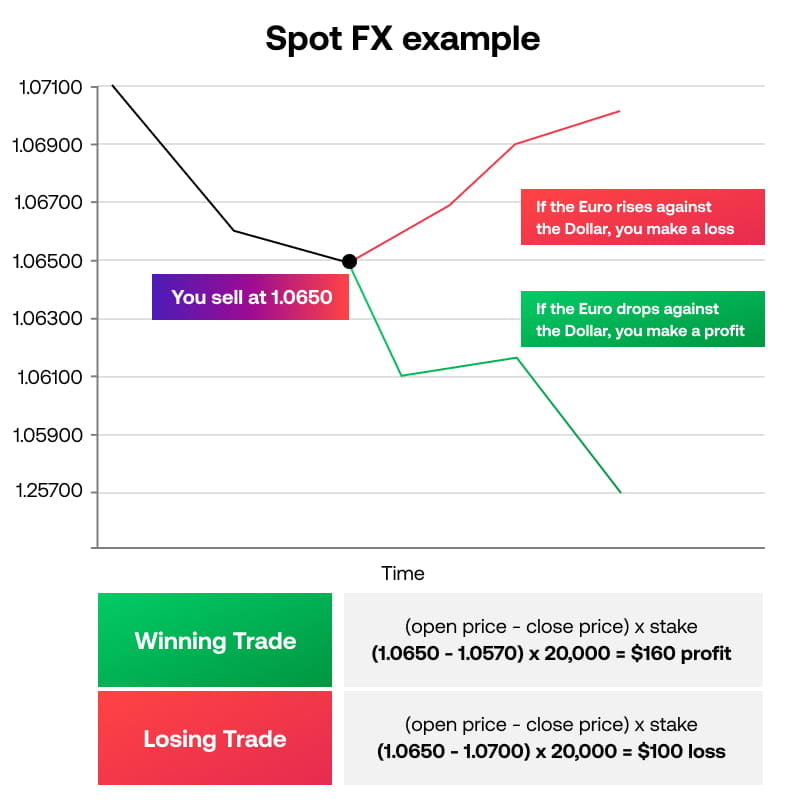

You do this when you assume the money's value will drop in the future. Businesses short a money to safeguard themselves from danger. Shorting is really dangerous. If the currency climbs in value, you have to buy it from the supplier at that price. It has the same pros and disadvantages as short-selling stocks.Report this wiki page